indiana tax payment plan

You must include Schedules 1 add-backs 2 deductions 5. Some tax professionals may offer payment services but it is still your responsibility to ensure the correct payment amount due arrives on time.

Indiana Income Tax Calculator Smartasset

Mail in your payment.

. Then visit intimedoringov to get started. The Indiana Department of Revenue plans. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes.

Your browser appears to have cookies disabled. When filing you must include Schedules 3 7 and CT-40 along with Form IT-40. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically.

There are three stages of collection of back Indiana taxes. The most efficient way to set up a payment plan is through INTIME DORs e-services portal. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

That means Californians who receive 10K or 20K of debt relief from the Biden plan may have to pay state taxes on the amount forgiven. Know when I will receive my tax refund. Set Up a Payment Plan with INTIME.

Check out these steps for making a payment. A payment can be made without logging in. Individuals who owe more than 100 and businesses that owe.

Set Up a Payment Plan with INTIME. Using a preprinted estimated tax voucher issued by the Indiana Department of. Find Indiana tax forms.

Cookies are required to use this site. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Per the government site Direct deposit MCTR payments for Californians who received Golden State Stimulus GSS I or II are expected to be issued to bank accounts from October 7 2022.

Hoosiers wishing to take advantage of this option can find out if they are eligible by. You filed your Indiana Individual income tax return and for the first time in a long time you owe a balance. Indiana DOR payment plans are an option for taxpayers who cannot pay their Indiana state tax bill in full at the time it is due.

1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US. Instead you need to consider your ability to pay over a period of time. The DOR will allow taxpayers to set up a monthly tax payment plan to pay their tax liability over time.

However the DOR requires that taxpayers have a balance greater than 100. A payment can be made without logging in. To make a payment on your payment plan go to INTIME.

To make a payment on your payment plan go to INTIME. Then visit intimedoringov to get started. If you have a stable job then you should be able to speak with the IRS or Indiana Department of Revenue about a.

Find Indiana tax forms. 2021 IT-40 Income Tax Form. Payment plans can be set from 3 to 36-month increments depending on the amount of the tax bill.

Begin the process from the All Actions tab where you will find the Payment Plan panel and click on Add a payment plan Once you decide to set up a payment plan confirm it by. The best option is to pay the entire. Know when I will receive my tax refund.

Indiana House Republicans Pushing Ahead On Tax Cut Plan

![]()

A Review Of Indiana S State Tax Payment Plan

Health Advocates Fighting Plan To Cut Indiana S Vaping Tax Wish Tv Indianapolis News Indiana Weather Indiana Traffic

Free Payment Plan Agreement Template Word Pdf Eforms

Indiana Department Of Revenue Offering Several Tax Payment Options To Hoosiers Owensboro Radio

Indiana Department Of Revenue Facebook

Agency Announcement Indiana Dor Adds More Features To New Indiana Tax System

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

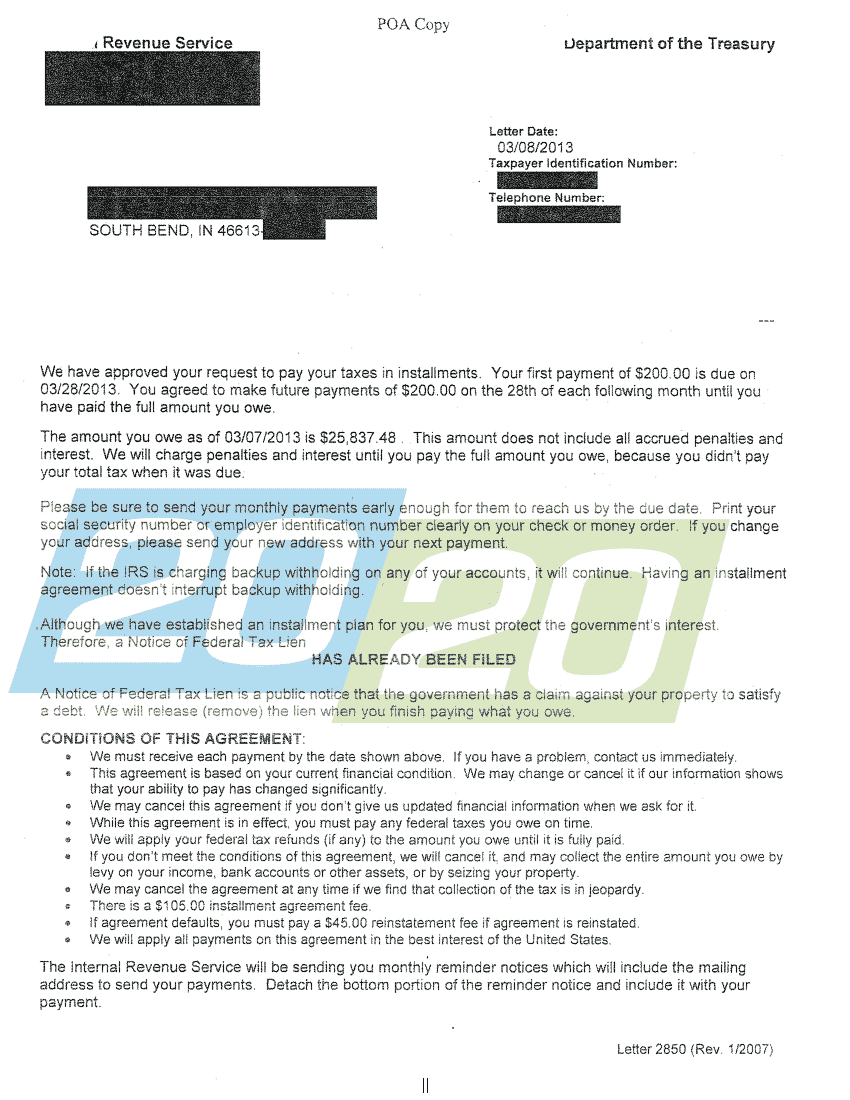

Irs Accepts Installment Agreement In South Bend In 20 20 Tax Resolution

/cloudfront-us-east-1.images.arcpublishing.com/gray/5LLRSBRU3JF6DFLCU5MXIUPIQE.jpg)

Indiana Governor Sets Special Session On Tax Refund Plan

Instructions For Form 9465 10 2020 Internal Revenue Service

Indiana Governor Signs Gradual Income Tax Cut Plan Into Law

The War In Ukraine Pandemic Could Drive Up Your Energy Bills Too News Indiana Public Media

/1040-V-df038816cc244b248641f447493a030d.jpg)

Form 1040 V Payment Voucher Definition

Oops Here S What To Do If You Missed The Tax Deadline

Indiana Dept Of Revenue On Twitter Estimated Tax Payments Are Due Tomorrow Sept 15 Payments Can Be Made Through Intime Https T Co 67kfkbrldq Indor Intime Https T Co Rzfybbhlyy Twitter

Indiana Officials Plan 125 Refund To Taxpayers From Surplus Wgn Tv

Indiana House Republicans Pushing Ahead On Tax Cut Plan Indiana News Tribstar Com